The market is surrounded by a lot of discussions on an interesting topic: market breadth. For those unfamiliar with the term, market breadth refers to the percentage of stocks making new highs versus new lows, along with an assessment of the overall market internals.

It’s very similar to peering under the hood of a car to examine its inner workings. In this article, we will go into the concept of market breadth, analyze its current state, and explore the arguments put forth by the bulls and bears regarding its implications for the market.

Understanding Market Breadth

Market breadth serves as an essential indicator of market health and participation. It goes beyond merely looking at the performance of a few well-known stocks and instead assesses the collective performance of a broader range of stocks.

By examining the breadth of the market, we gain insights into whether the market rally is being driven by a handful of dominant stocks or if it is more widely dispersed across various sectors and companies.

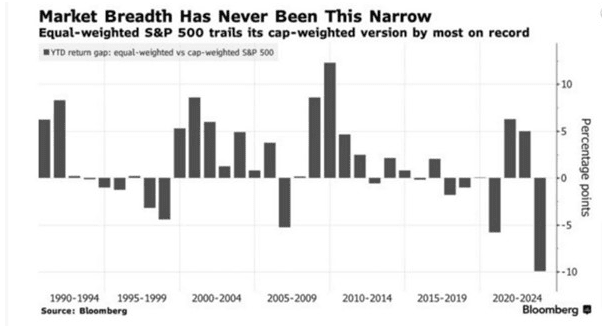

According to Bloomberg data so far this year only a handful of stocks are driving the market higher but when we look at it on a broader scale the market underlying is not looking good at all.

The Troubling Market Breadth

Currently, market breadth has been a cause for concern among market participants. The prevailing trend suggests that a select few stocks have accounted for the majority of market gains. This concentration of performance raises questions about the sustainability and longevity of the market rally.

Also Read: Looming Debt Ceiling Crisis

To highlight the disparity, we can compare the performance of the equal-weighted index RSP to the market cap-weighted index SPY. The difference between the two indices has reached its highest point in the past year, signifying the unequal distribution of market gains.

The Bullish Perspective

Bulls argue that in times of war, it is the generals who lead the charge. Similarly, they contend that it is not unusual or alarming to witness poor market breadth during a rally.

According to their viewpoint, as long as a few prominent stocks continue to drive the market higher, it is a normal occurrence that can be embraced. They maintain that these market leaders possess strong fundamentals and market dominance, leading to sustained growth despite the lack of broad-based participation.

The Bearish Stance

On the contrary, bears contend that a rally’s sustainability hinges upon broad-based participation, with every stock contributing to the upward momentum. They argue that if the market breadth remains poor, it indicates a lack of confidence and participation from a broader range of stocks.

According to the bearish perspective, a market rally heavily reliant on a handful of stocks is susceptible to a sudden reversal, posing risks to investors who have not diversified their portfolios adequately.

What Side Are You On?

Now the question arises: which side are you on? Are you a member of Team Bear or Team Bull? The answer to this question depends on your risk appetite, investment strategy, and interpretation of market dynamics.

There is no definitive right or wrong answer, as market sentiment and conditions are subject to change. It is crucial to conduct thorough research, consult with financial advisors, and evaluate your investment goals before aligning yourself with one viewpoint.

Final Take

Market breadth plays a pivotal role in understanding the dynamics of the stock market. While the current state of market breadth raises concerns, it also sparks an intriguing debate between the bulls and bears.

The arguments put forth by each side shed light on their respective perspectives regarding the importance of broad-based participation in sustaining a market rally. Ultimately, the choice between being bullish or bearish depends on individual interpretation and risk tolerance.