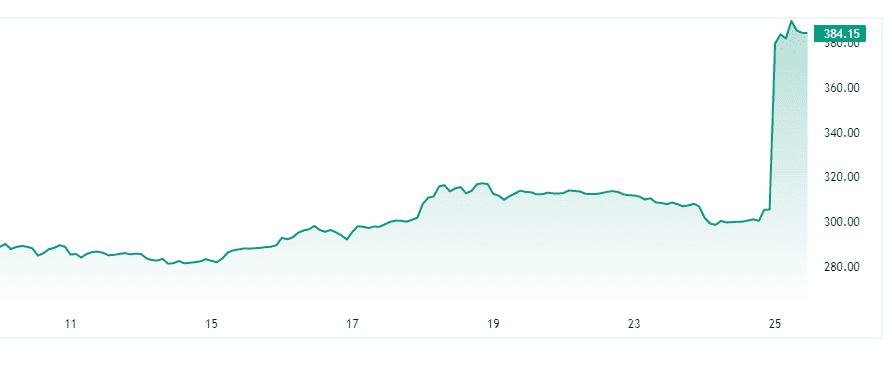

[Chicago, May 25, 2023] NVIDIA (Ticker: NVDA), the renowned semiconductor chip maker company, recently announced its highly anticipated earnings report following the market’s closure yesterday. Nvidia earnings were nothing short of remarkable as the company surpassed expectations across the board beating the top and bottom line.

It showed substantial growth in both revenue and earnings per share (EPS). This exceptional performance has sent NVIDIA’s stock soaring, with pre-market trading showing a remarkable 27% surge. Such news undoubtedly delights investors and underscores the company’s positive outlook for the future.

Nvidia Earnings – Revenue and EPS Growth

NVIDIA’s revenue witnessed a notable increase of 11%, greatly surpassing projections. This substantial rise is a testament to the company’s strong market presence and effective strategies. Moreover, NVIDIA’s EPS exceeded expectations by an impressive 18%, solidifying its position as an industry leader.

During the earnings call, NVIDIA’s executives expressed their optimism for the future, citing higher demand and increased forecasts for the second quarter. The company now expects to generate a staggering $11 billion in revenue, significantly surpassing market expectations that hovered around $7 billion.

Generative AI as a Key Growth Driver

The company has witnessed a surge in orders for chips that power generative AI systems, leading to increased efficiency and demand. NVIDIA has already forged partnerships with industry giants such as Dell and Microsoft to enhance generative AI capabilities, further amplifying their revenue and profit margins.

Jensen Huang, CEO of NVIDIA, emphasized the significant shift occurring within data centers, predicting a dramatic transition from traditional computing to accelerated computing.

This shift entails the adoption of smart NICs, smart switches, and GPUs, with a generative AI workload anticipated to dominate the landscape. These insights affirm NVIDIA’s expectation of continued growth within its data center division.

NVIDIA also revealed an extraordinary demand for overhauling or repurposing old data centers, specifically those utilizing NVIDIA chips. This presents a long-term advantage for the company, as they continue to cater to the evolving needs of businesses.

Also Read: Can Nvidia turn around crypto

Investors with a long-term perspective can capitalize on this trend by entering the market and employing dollar-cost averaging to build their portfolios.

Options Investors: Seize the Opportunity

For options investors, NVIDIA’s positive trajectory presents an enticing opportunity to explore various strategies. Covered calls, call credit spreads, and call debit spreads are all potential avenues to consider when engaging with NVIDIA’s stock. These strategies allow investors to leverage the current market conditions and potentially enhance their returns.

What’s our take

NVIDIA proves to be a stock worth considering for any portfolio. With its commitment to innovation, the company is well-positioned to achieve the distinction of becoming the first trillion-dollar market-cap semiconductor chip maker. If you are a growth investor then Nvidia deserves a golden seat in your portfolio.

1 thought on “NVIDIA Earnings Surpasses Estimates and Highlights Generative AI Growth”