Cathie Wood’s investment firm, ARK Investment, continues to reinforce its position in Palantir Technologies Inc., as it recently added approximately $4 million worth of Palantir shares across multiple funds.

This strategic move showcases ARK’s confidence in Palantir’s potential and reinforces its commitment to capitalizing on promising investment opportunities in the technology sector. In this article, we will delve into the details of ARK’s recent investments and the notable performance of Palantir in the market.

ARK Innovation ETF

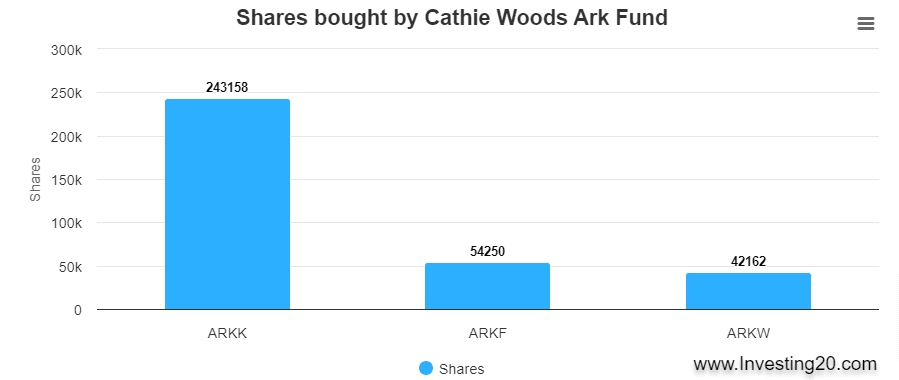

As part of its ongoing investment strategy, the ARK Innovation ETF (ARKK) acquired an impressive 243,158 shares of Palantir, totaling approximately $2.9 million in value. This substantial purchase demonstrates ARK’s strong belief in Palantir’s ability to generate significant returns in the future.

ARK Fintech ETF

Recognizing the promising prospects of Palantir in the fintech domain, the ARK Fintech ETF (ARKF) recently purchased 54,250 shares of the company, amounting to around $642,000. By investing in Palantir, ARKF aims to benefit from the company’s disruptive solutions and cutting-edge advancements in the fintech sector.

ARK Next Generation ETF

In line with its forward-thinking investment strategy, the ARK Next Generation ETF (ARKW) expanded its stake in Palantir by acquiring 42,162 shares, valued at just under $500,000. With Palantir’s strong focus on artificial intelligence and data analytics, ARKW aims to harness the opportunities arising from the rapid advancements in these fields.

Palantir’s shares have experienced remarkable growth, surging over 50% since the release of the company’s earnings report earlier this month. The positive momentum stems from Palantir’s consecutive quarters of GAAP profitability and its ambitious vision regarding artificial intelligence.

While some analysts perceive certain negative signals in the latest results, Palantir’s overall trajectory and commitment to technological advancements continue to captivate investor interest.

Cathie Wood’s ARK Investment has once again demonstrated its proactive investment very similar to her Tesla investment strategy by adding $4 million worth of Palantir shares across multiple funds.

1 thought on “Cathie Wood’s ARK Funds Acquire $4 Million Worth of Palantir Share”