Rich dad poor dad is one of my favorite books on investing I believe everyone should read irrespective of whether you are an active investor or not. It has some life-changing lessons that change your perspective of how to see finance, money, and investing.

Here is a rich dad poor dad summary and my top 10 lessons from the book.

Rich Dad Poor Dad Summary

The importance of financial literacy

In Rich Dad Poor Dad, Robert Kiyosaki emphasizes the importance of understanding and managing one’s finances. He argues that financial literacy is essential for achieving financial success and independence and that it is not taught in schools.

The power of Entrepreneurship

Kiyosaki advocates for entrepreneurship as a way to achieve financial freedom. He argues that by starting and running a successful business, one can gain control over their financial future and create passive income streams.

The dangers of relying on a single source of income

Kiyosaki advises against relying on a single source of income, such as a salary or wages, as it makes one vulnerable to economic downturns and layoffs. He advocates for diversifying one’s income streams and building multiple sources of income.

The importance of asset management

Kiyosaki emphasizes the importance of managing and growing one’s assets, rather than just focusing on increasing income. He argues that by acquiring and investing in assets that generate passive income, one can achieve financial independence.

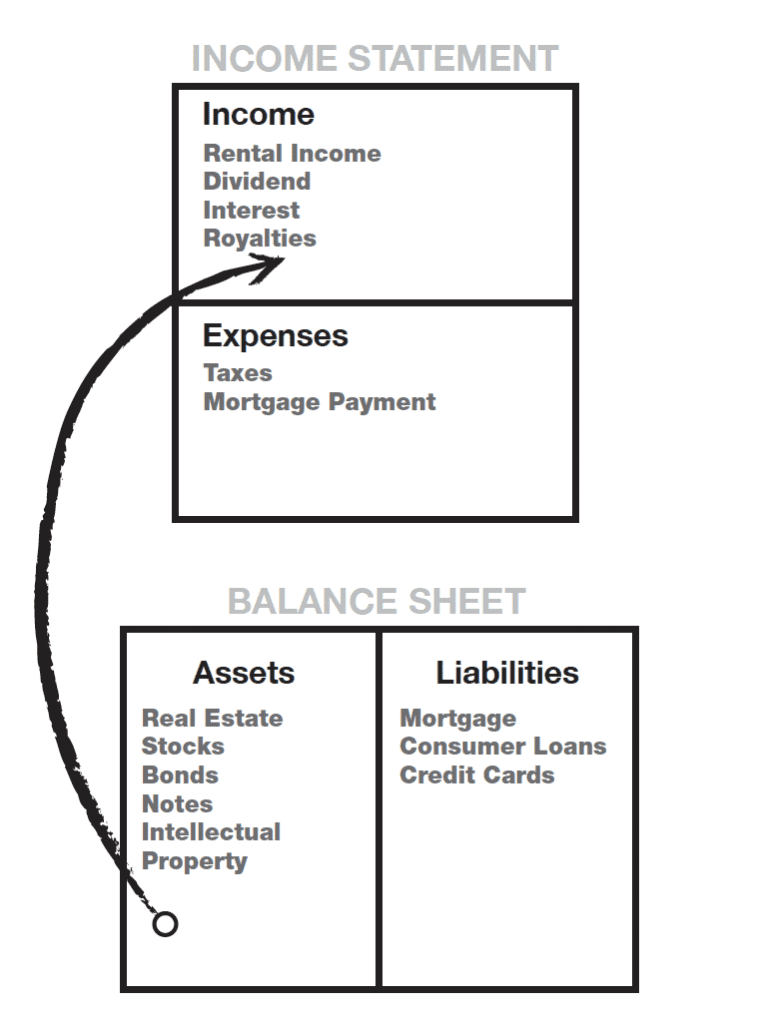

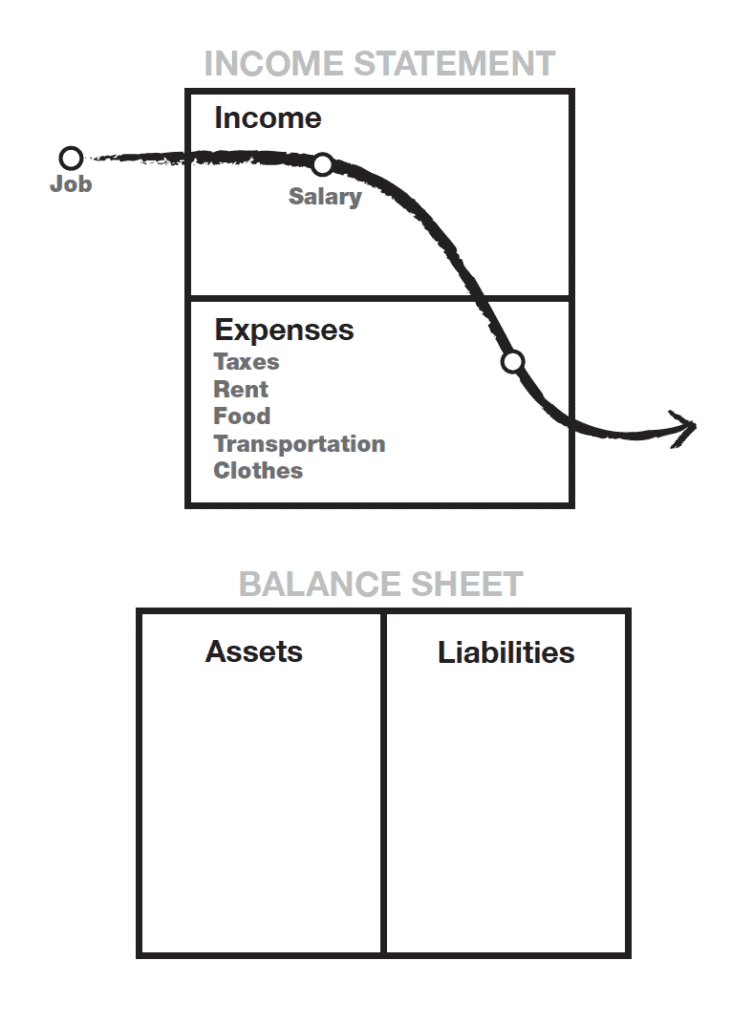

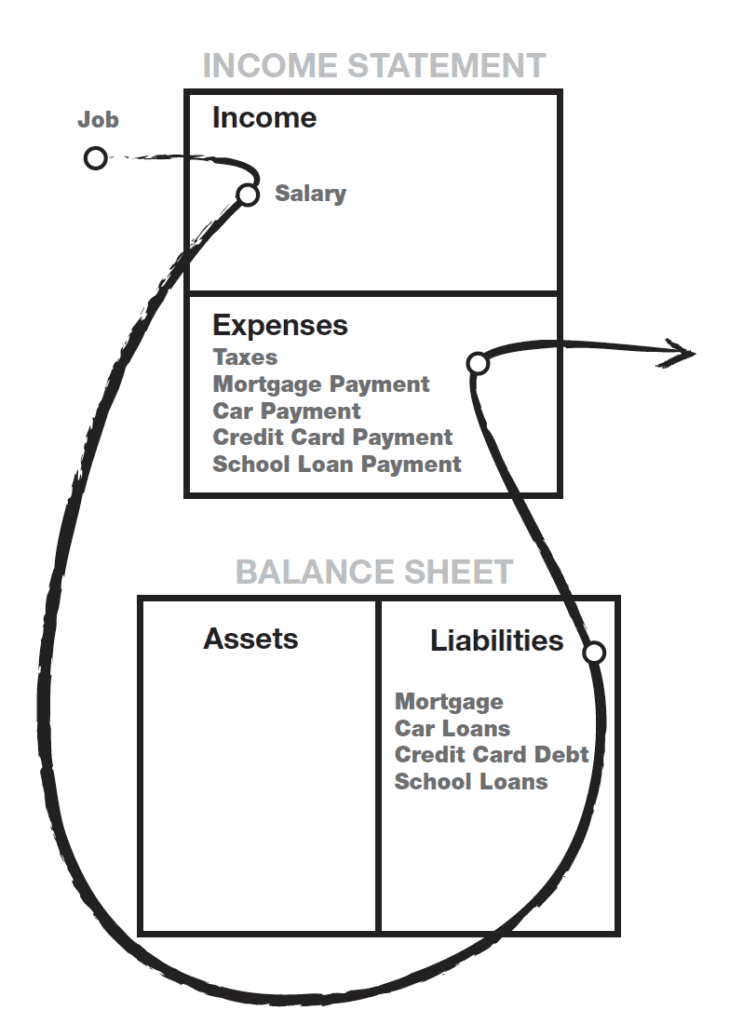

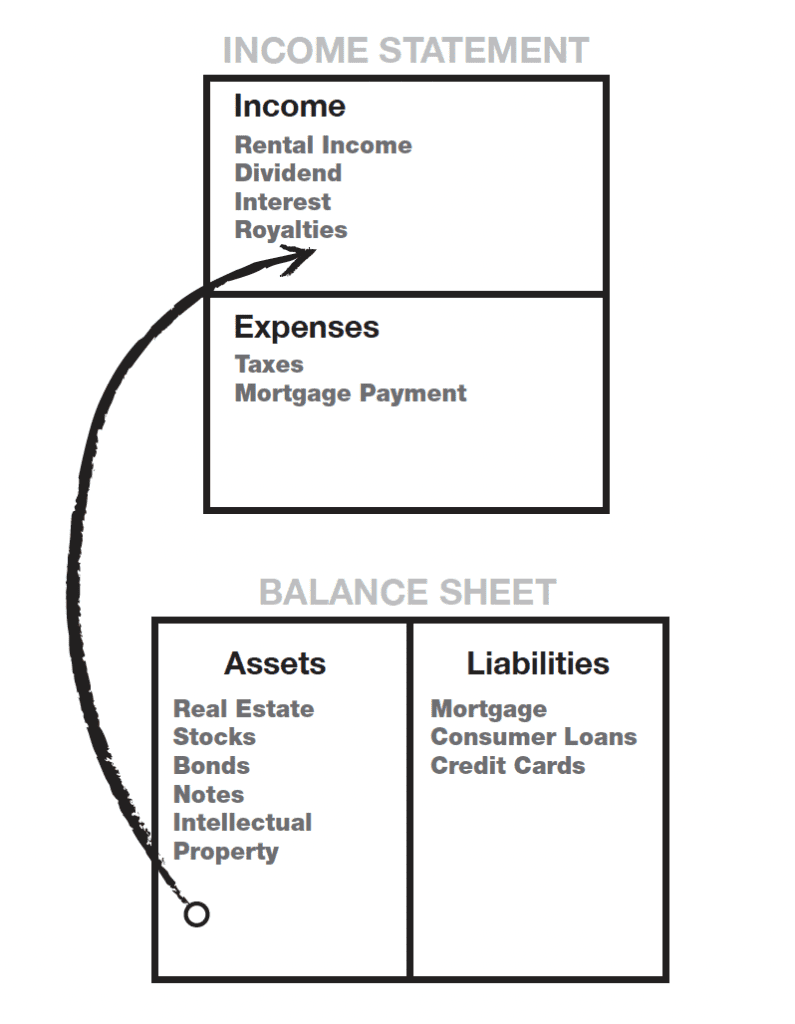

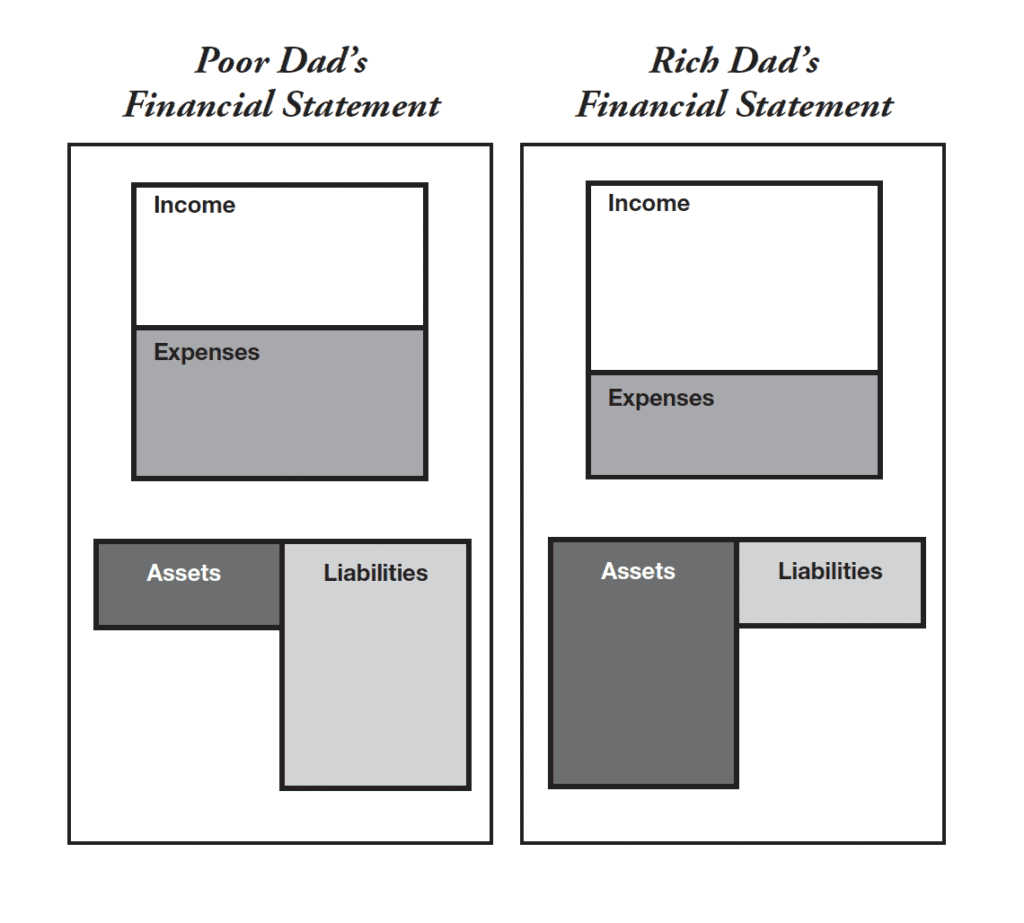

As you can clearly observe from his cash flow pattern flow how a poor person’s cash flow differs from a person in the middle and rich classes. It is all about building income-producing assets at the end. Rich will always have a growing list of assets that actually produce income.

The difference between good debt and bad debt

Kiyosaki distinguishes between good debt, which is used to acquire assets that generate income, and bad debt, which is used to finance consumption or lifestyle expenses. He advises against taking on bad debt and instead suggests using good debt to leverage investments and build wealth.

Must Read: 5 Must Read Books for Every Investor

The value of financial education

Kiyosaki stresses the importance of continuing to learn and educate oneself about finance, as it is essential for making informed financial decisions. He encourages readers to seek out mentors and resources that can provide guidance and knowledge about wealth-building strategies.

Delayed gratification in financial success

Kiyosaki argues that discipline and the ability to delay gratification are key to achieving financial success. He advises setting long-term financial goals and making sacrifices in the present in order to achieve them.

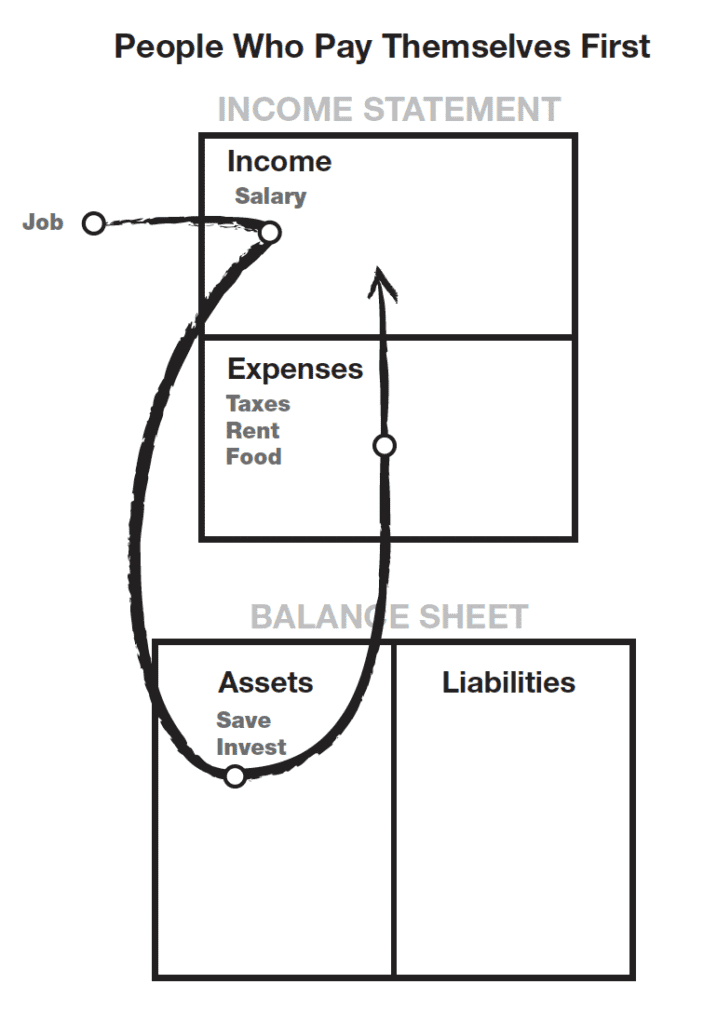

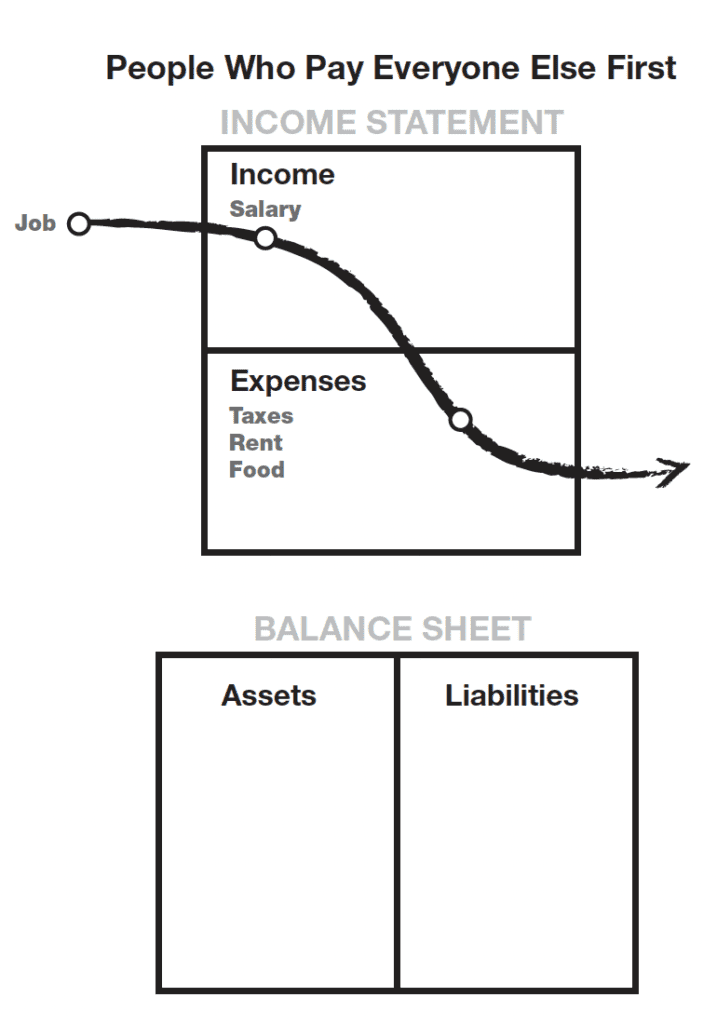

See how delayed gratification works on the flow diagram given in the rich dad poor dad book. You need to build a habit to pay yourself first before paying anyone else. That’s the key to building financial independence in long term.

The dangers of consumerism

Kiyosaki warns against falling into the trap of consumerism, which he defines as the constant desire to buy and consume more. He argues that this mindset leads to the accumulation of bad debt and financial insecurity.

The importance of taking calculated risks

Kiyosaki encourages readers to take calculated risks in order to achieve financial success. He argues that by carefully evaluating and analyzing potential investments and opportunities, one can minimize the risks and maximize the potential rewards.

The value of financial independence

Kiyosaki’s ultimate goal in Rich Dad Poor Dad is to empower readers to achieve financial independence and control over their financial lives. He encourages readers to take charge of their finances, educate themselves, and make smart financial decisions in order to achieve financial success.

Rich Dad Poor Dad Quotes

Here are ten quotes from the book Rich Dad Poor Dad by Robert Kiyosaki:

- “The rich don’t work for money. They make money work for them.”

- “The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth in what seems to be an instant.”

- “The rich invent money. The poor and middle-class work for money.”

- “The poor and middle-class work for money. The rich have money to work for them.”

- “The more you learn, the more you earn.”

- “You’re only poor if you give up. The fact that you did something is more important. Most people only talk and dream of getting rich. You’ve done something.”

- “The middle class is being squeezed out of existence. It is becoming harder and harder for people to stay in the middle class. Most people are living paycheck to paycheck and are one emergency away from being homeless.”

- “The rich focus on their assets. The poor and middle-class focus on their expenses.”

- “The rich focus on their net worth. The poor and middle-class focus on their working income.”

- “The rich focus on their financial intelligence. The poor and middle-class focus on their education.”

Rich Dad Poor Dad PDF | Rich Dad Poor Dad Audio Book

I would strongly argue that you add the rich dad poor dad pdf to your collection of books if you like the digital form of reading. If you have a kindle then kindly get a copy from amazon below and add it to your kindle collection forever. I can assure you that this would be the best investment you will ever make in a book.

Rich dad poor dad pdf

If you prefer a physical book get this one.

Audio Book

Rich Dad Poor Dad Game

As the famous saying goes that when you enjoy learning it is stick with you forever. That’s where the rich dad poor dad game helps you. It is designed by Robert Kiyosaki so everyone from a kid to an adult can benefit from the life lessons. A fun family game that teaches you all about finance and money while enjoying playing.

Get your copy today, you will not regret it.

The team of rich dads and poor dad keeps working on some interesting games from time to time. Refer to their site for more up-to-date information: https://store.richdad.com/collections/board-games/products/cashflow-board-game

Final Thoughts

In conclusion, the book Rich Dad Poor Dad by Robert Kiyosaki aims to educate readers about the importance of financial literacy and how to achieve financial success. Kiyosaki advocates for entrepreneurship, asset management, and diversifying one’s income streams as key strategies for building wealth. He also emphasizes the value of financial education, discipline, and calculated risk-taking in achieving financial independence. Through the use of personal anecdotes and financial advice, Kiyosaki encourages readers to take charge of their finances and make smart financial decisions in order to achieve financial success and independence.

3 thoughts on “Lessons from rich dad poor dad”