The United States government is facing an imminent debt ceiling crisis, with a rapidly approaching deadline of June 1st.

This impending deadline has put the government in a difficult position, as it needs to make a multitude of crucial payments that must be made.

Debt Ceiling Deadline Approaching Fast

Among the top priorities are the Medicare payments, which amount to a staggering 47 million dollars. Additionally, the government needs to allocate 24 billion dollars for government retirement plans and veteran benefits, all due on June 1st.

The challenges do not end there. On June 2nd, the government must disburse an additional 25 billion dollars to Social Security recipients. With such significant financial obligations to fulfill, the US government finds itself at a crossroads, faced with the daunting task of choosing which payments take precedence.

Bondholders are also eagerly awaiting their payments, and defense expenditures cannot be neglected. It remains to be seen which of these financial responsibilities will take priority during this critical period. The government’s decision will have far-reaching implications, impacting various sectors and stakeholders.

Impact on Stock Market Due to Debt Ceiling Crisis

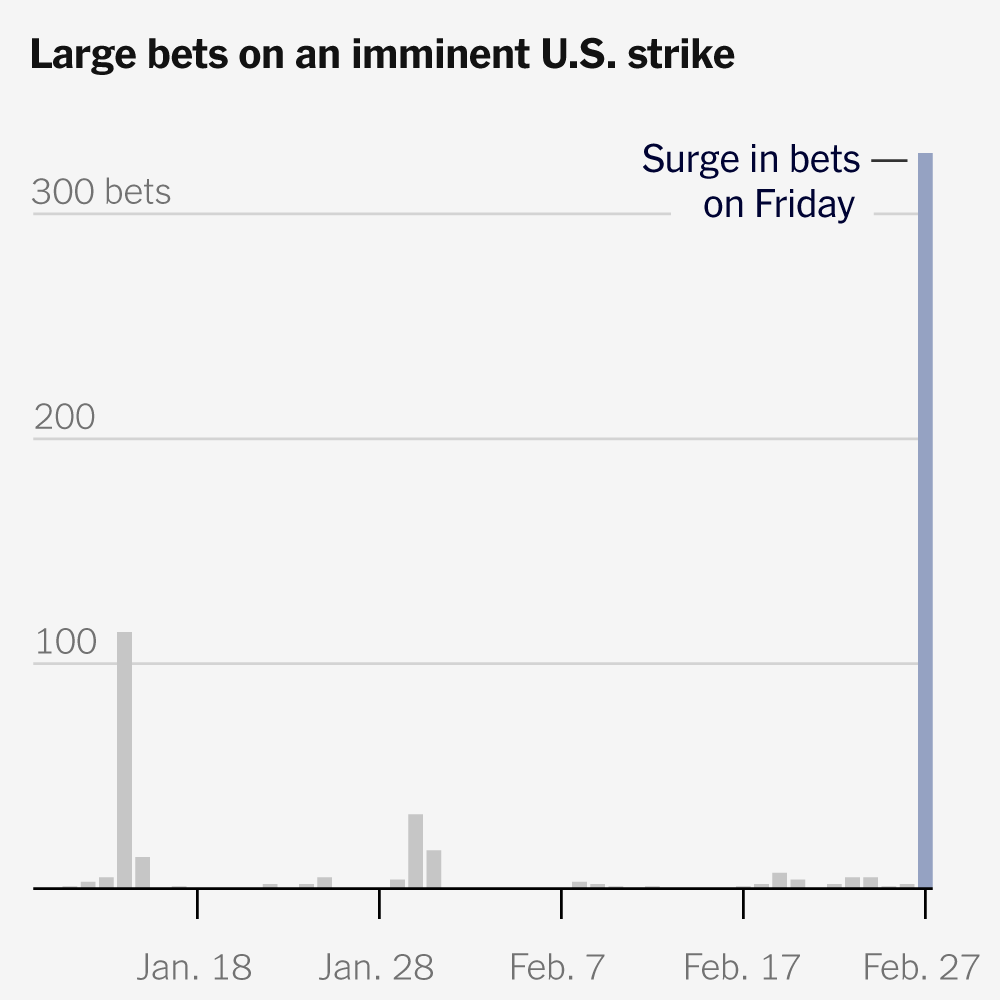

The ongoing debt ceiling crisis will have a profound effect on the financial markets. In the weeks of June 1st to the 2nd week, market observers are predicting a highly volatile ride. Investors should brace themselves for turbulent times ahead.

Also Read: Debt Ceiling Impact on Social Security

For conservative investors, it is advisable to exercise caution and consider staying out of the market during this particular week. The uncertainty surrounding the government’s payment priorities and the potential market fluctuations make it a risky period for those seeking stability in their investments.

However, for traders who thrive on market volatility, this presents a unique opportunity to make strategic moves and capitalize on the fluctuations. By carefully analyzing the market and making informed decisions, traders can potentially seize advantageous positions and turn the volatility to their advantage.

The upcoming weeks will undoubtedly test the resilience of the financial markets, offering both risks and rewards for those who dare to participate in this wild ride.

1 thought on “Looming Debt Ceiling Crisis Puts US Government in a Tough Spot”