Social Security

Social Security is a critical program in the United States that provides income support to retired and disabled individuals, as well as surviving family members of deceased workers. However, the debt ceiling has the potential to disrupt the smooth functioning of Social Security and jeopardize the benefits that millions of Americans rely on.

United States Debt Ceiling

The purpose of the debt ceiling is to provide a mechanism for Congress to exercise control over the government’s borrowing activities. It serves as a check on the executive branch’s ability to accumulate excessive debt without proper oversight. By setting a limit on borrowing, Congress aims to ensure fiscal responsibility and maintain the country’s long-term financial stability.

US Debt Ceiling Deadline

When the U.S. hits the debt ceiling, it means that the government is unable to borrow more money to meet its financial obligations. This can have severe repercussions for Social Security, as it relies on a steady stream of funding from the government to pay benefits to eligible individuals. If the government is unable to borrow more money due to reaching the debt ceiling, there may be a risk of delayed or reduced Social Security payments.

One concern that arises during discussions about the debt ceiling is whether creditors can go after Social Security income. It is important to note that Social Security benefits are protected by law from being garnished or seized by creditors. The Social Security Act includes provisions that safeguard Social Security payments, ensuring that they are exempt from most debt collection efforts. This protection helps to provide a level of financial security for Social Security beneficiaries.

Also Read: File your Facebook Settlement Claims Now

Debt Ceiling Deadline 2023

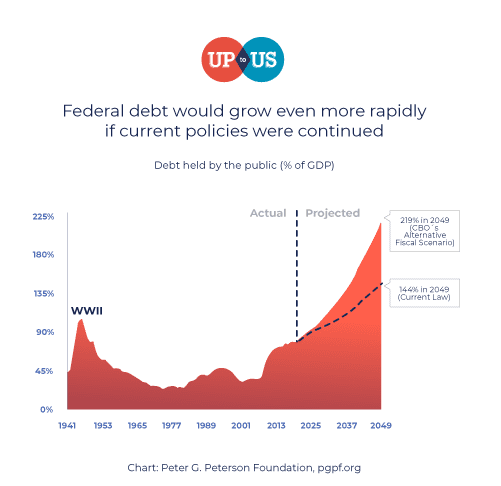

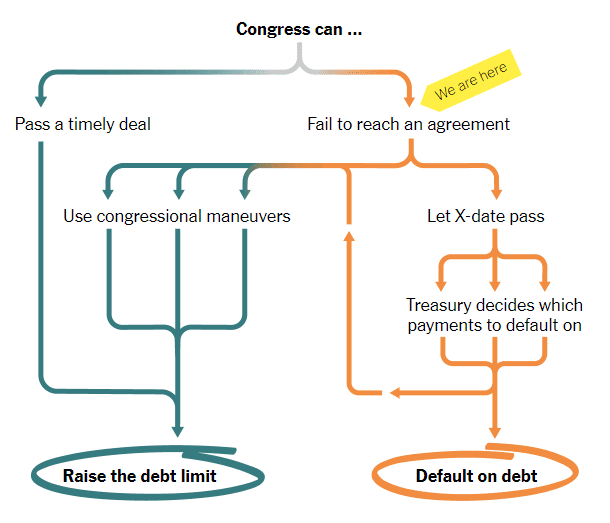

The approaching Debt Ceiling Deadline in 2023 has raised concerns and created a sense of urgency among policymakers and financial experts. The Debt Ceiling, which represents the maximum amount of money the United States government can borrow, has been a topic of frequent political debates and negotiations. Failure to raise the debt ceiling by the deadline could have significant consequences for the country’s economy and financial stability. It may result in a potential default on U.S. government debt, leading to a downgrade in the country’s credit rating and increased borrowing costs. This situation has heightened the need for prompt action and decision-making to address the issue and prevent any adverse effects on the nation’s fiscal well-being.

Image Source: NY Times

14th Amendment

The 14th Amendment to the U.S. Constitution is often brought into the debate surrounding the debt ceiling. The 14th Amendment states that the validity of the U.S. public debt “shall not be questioned.” Some argue that this clause gives the President the authority to bypass the debt ceiling and ensure the payment of all debts, including Social Security benefits. However, the interpretation and implementation of the 14th Amendment in relation to the debt ceiling remain subjects of legal and political debate.

Impact on your Social Security

Debt collection from Social Security funds is generally not permitted. Social Security benefits are intended to provide a stable source of income for eligible individuals, and efforts are made to ensure that they are not offset or withheld to satisfy outstanding debts. However, it is essential for individuals to manage their overall debts responsibly to avoid financial complications.

In the event of a default on the national debt, where the U.S. government is unable to make timely payments on its obligations, Social Security could be impacted. A default could lead to a financial crisis, causing disruptions in the economy and financial markets. This could, in turn, affect the government’s ability to allocate funds for Social Security payments, potentially leading to delayed or reduced benefits for beneficiaries.

It is worth noting that Social Security has experienced periods of running a surplus. This occurs when the program’s income exceeds its expenses. When Social Security runs a surplus, the excess funds are used to purchase U.S. Treasury securities, effectively lending money to the government. These surplus funds play a role in financing the government’s operations and reducing the need for additional borrowing. However, the surplus alone is not sufficient to cover the entirety of the national debt or eliminate the need to address the debt ceiling issue.

If an individual has incurred Social Security debt, it is essential to take steps to clear it. Options for clearing Social Security debt may include repayment plans, negotiation with the Social Security Administration, or seeking assistance from debt management agencies. Prompt action is crucial to avoid potential consequences, such as the reduction or suspension of benefits.

National Debt Ceiling

As for the U.S. national debt, it is an enormous financial obligation that has accumulated over the years. Clearing the entire national debt is a complex task that requires careful planning, economic policies, and fiscal discipline. While it is unlikely that the U.S. will completely pay off its debt, there are efforts to manage and reduce it to maintain a stable and sustainable economy.

The debt ceiling has been suspended multiple times in the past to prevent default and allow the government to continue borrowing money. The suspension of the debt ceiling temporarily removes the statutory limit, providing more flexibility in managing the national debt. However, the suspension is not a permanent

FAQ

What is the debt ceiling?

The debt ceiling refers to the legal limit set by Congress on the amount of money that the U.S. government can borrow to meet its financial obligations.

Is Social Security affected by the debt ceiling?

Yes, Social Security can be affected by the debt ceiling. If the U.S. hits the debt ceiling, there is a risk of delayed or reduced Social Security payments.

What does the debt ceiling mean for Social Security?

The debt ceiling impacts Social Security by potentially disrupting the flow of funding from the government, which is essential for paying benefits to eligible individuals.

What does the 14th Amendment have to do with the debt ceiling?

The 14th Amendment to the U.S. Constitution states that the validity of the U.S. public debt “shall not be questioned.” It has been invoked in debates about the President’s authority to bypass the debt ceiling and ensure the payment of all debts, including Social Security benefits.

What happens if the U.S. hits the debt ceiling?

If the U.S. hits the debt ceiling, the government may be unable to borrow more money to meet its financial obligations. This can lead to potential disruptions in various government programs, including Social Security.

Can creditors go after Social Security income?

No, creditors generally cannot go after Social Security income. Social Security benefits are protected by law from being garnished or seized by creditors.

Can debt be taken from Social Security?

In general, debt collection from Social Security funds is not permitted. Social Security benefits are intended to provide income security and are protected from most debt collection efforts.

What happens to Social Security if the U.S. defaults on debt?

If the U.S. defaults on its debt, there could be severe consequences for Social Security. It could lead to financial instability, disruptions in the economy, and potentially result in delayed or reduced Social Security payments.

What happens when Social Security runs a surplus?

When Social Security runs a surplus, the excess funds are used to purchase U.S. Treasury securities, which helps finance the government’s operations. However, the surplus alone is not enough to cover the entire national debt or eliminate the need to address the debt ceiling issue.

How do I clear my Social Security debt?

To clear Social Security debt, individuals should take steps such as setting up repayment plans, negotiating with the Social Security Administration, or seeking assistance from debt management agencies. Prompt action is crucial to address the debt and avoid potential consequences.

Will the U.S. ever have to pay off its debt?

While it is unlikely that the U.S. will completely pay off its debt, there are efforts to manage and reduce it. The focus is on maintaining a stable and sustainable economy rather than entirely eliminating the debt.

3 thoughts on “Debt Ceiling Impact on Social Security”