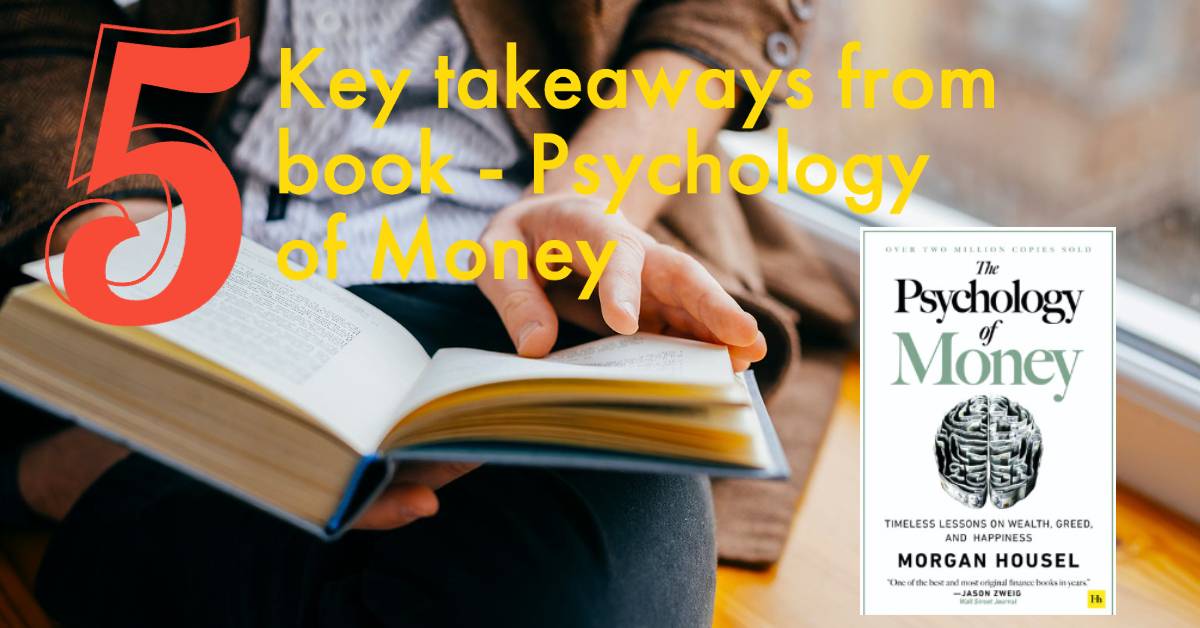

Key takeaways from book – Psychology of Money

In this article, let’s summarize the top five learning and my takeaway from the book psychology of money. This is probably one of the most popular books in recent times around the personal financing space.

The book’s primary focus is not so much on how to invest money or how to invest money rather it is on how we think and behave fundamentally about money. Here are my top 5 takeaways from this book which is

- Protect Capital

Many people become rich but then they also end up losing all of it very soon there are so many such examples we can see in history that’s why it’s very important to constantly protect your wealth. The primary focus of investing should be avoiding bad decisions. Give equal importance to wealth protection which you usually give to generating wealth. It is necessary to take risks but it’s equally important to preserve capital. Building wealth has little to do with your income or investment returns but a lot to do with your savings rate. There is a lot of uncertainty and risk in the first two. But saving is the only factor that you control. You can build wealth without a high income, but there is no way you can build wealth without a high savings rate.

2. Financial Independence

This is the central theme for most of the personal financing books however it is imperative to mention it here as it would not be complete without this. Money should be used to gain financial independence “You will be truly wealthy if you use your money to buy time” When you can do whatever you want, whenever you want, and for as long as you want you will be truly financially independent.

3. Being wealthy vs Being Rich

The third takeaway is that real wealth is not what is seen but what we do not see. The only difference between being wealthy and being rich is that it is not difficult to recognize rich people because they own luxury cars and expensive houses. Even if they have bought it on EMIs. In our society, people judge your wealth by your spending ability. But wealthy people do not spend most of their income. Their real wealth is in the form of assets such as stocks, rental income, intellectual property, etc. Wealthy people use their money to grow themselves and to give themselves greater flexibility and the ability to make choices.

4. Always have a Plan B

The fourth learning is that we should always be ready for surprises and unknown events and keep a plan B ready. In fact, start from Plan B before you go to Plan A. We must accept the randomness and uncertainty in life and plan for it. For this, we have to solve the difference between two things- What is about to happen and What could happen? Often we take all the decisions thinking about what is going to happen according to us and do not think about what could happen, and if it happened, then how we would be able to face the situation. The reason for this is that we always think that we should know what is going to happen in the future. It is very difficult for us to admit that we do not know much about what will happen tomorrow, and therefore, we should be prepared for uncertain events.

5. There are no free lunches

The fifth and last learning is that nothing is free in the world. For example, social media handles are free but in reality, they are asking for your time and data instead of money. Therefore, everything has a price. We should know what that price is, and then decide whether we want to pay it or not. Similarly, if we talk about investment, we also have to pay a price that you cannot measure in dollars or rupees. The real price of investing is to deal with various emotional and mental states like fear, doubt, uncertainty, greed, and regret. According to Morgan Housel, instead of being afraid of market volatility, we need to think of it as a fee or a cost that one needs to pay to become a good investor. In investing, until we deal with emotions and invest rationally, we will not be able to be good investors.

There are many more points in this book that you may be able to relate to. I would highly recommend that you pick this book doesn’t matter you are a novice in investing world or a pro-investor.

1 thought on “5 takeaways from the book – Psychology of money”