What?

There are many ways to define investing. In this article, let’s define Investing 101 as what why How, and how much to invest. Here are some of the common ways to think about investing.

Investing refers to the act of committing money or capital to an endeavor with the expectation of obtaining an additional income or profit. Investing often involves the purchase of assets, such as stocks, bonds, real estate, or other securities, with the goal of generating a return on the investment.

Investors may seek to generate income through dividends, interest, or rental income, or they may hope to sell their assets at a higher price in the future. Investing can be a way to grow and preserve wealth, but it also carries risks, as the value of investments can fluctuate over time.

It is about putting your money to work over a period of time in any tangible or nontangible assets for example houses, stocks, and businesses in hopes of generating profit. Investing comes with losing money should your stock or business go down however investing is considered better than saving to give a greater return on money compared to saving if done properly.

Why?

There are multiple reasons why you should get into Investing.

First, it can help you grow and preserve your wealth over time. By investing your money, you have the opportunity to earn a return on your investment, which can help you increase your net worth and achieve your financial goals.

Second, it can provide a source of passive income. Many types of investments, such as stocks and bonds, pay dividends or interest, which can provide a steady stream of income without requiring you to actively work for it.

Third, it can help you diversify your portfolio and manage risk. By investing in a variety of assets, you can spread out your risk and potentially reduce the impact of market fluctuations on your overall portfolio.

Must Read Books On Investing

Finally, investing can be a way to support the economy and contribute to the growth of businesses and industries. By investing in companies and projects, you can help provide the capital they need to grow and succeed.

It is a successful approach to using your money and possibly increasing your fortune. Your money may grow in value and outpace inflation if you make wise investment decisions. The power of compounding and the trade-off between risk and return is the main reasons investment has higher growth potential.

How?

The HOW part depends on a lot of factors but primarily there are four major parts of this:

- Your financial goals

- The timeframe that means your short-term and long-term return targets

- Your risk appetite

- Do it yourself or managed it for you

Below are the steps that you can follow how to start investing:

How to start Investing

Determine Investing Goals

What do you want to achieve through investing? Do you want to save for retirement, generate income, or grow your wealth? Your goals will help you determine what types of investments are appropriate for you.

Assess Risk Tolerance

Consider how much risk you are willing and able to take on. This will help you determine the types of investments that are suitable for you and how much of your portfolio should be allocated to each asset class.

Create Budget

Determine how much you can afford to invest and how you will save for your investments. Consider setting up automatic transfers from your checking account to your investment account to help you save consistently.

Choose an investment account

Decide where you will hold your investments. Options include brokerage accounts, 401(k) plans, and individual retirement accounts (IRAs).

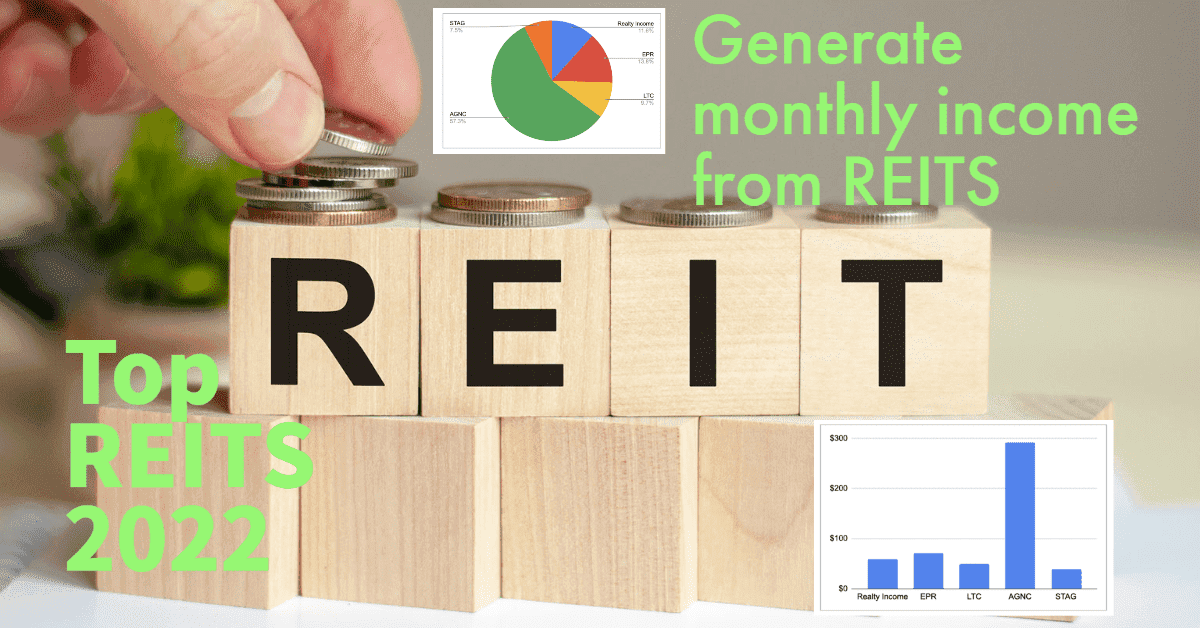

choose your investments

Once you have an investment account set up, you can start researching and choosing the investments that are right for you. This may include stocks, bonds, mutual funds, exchange-traded funds (ETFs), or other securities. Consider working with a financial advisor or conducting your own research to make informed investment decisions.

Monitor and review your investments:

It’s important to regularly review your investments to ensure they are meeting your goals and to make any necessary adjustments. It’s also important to diversify your portfolio to help manage risk.

How Much?

According to a lot of studies below is a blueprint of how much you should be investing every month.

- 50% of your take-home pay should be allocated to essential expenses (housing, food, health care, transportation, child care, debt repayment)

- 15% of pretax income (including employer contributions) should be invested for retirement

- 5% of take-home pay is used for short-term savings like an emergency fund

- That leaves about 30% of your income that can be used for discretionary expenses, like entertainment and dining out, or more savings.

Must Read: Reasons why people fail at Investing in the Stock Market

So anyone has to target at least 15% out of that 30% towards investing. Of course, this is only a general guideline but sticking to this for a long period of time will yield a secure financial future for you.

Final Thoughts

In conclusion, investing is an important way to grow and preserve wealth, generate passive income, and support the economy. To start investing, it is important to determine your investment goals, assess your risk tolerance, create a budget and savings plan, choose an investment account, research and choose your investments, and regularly monitor and review your investments. By following these steps, you can begin building a strong investment portfolio that can help you achieve your financial goals. It is also advisable to seek the guidance of a financial advisor, who can provide expert advice and help you navigate the investment process.

1 thought on “Investing 101 – What, Why, How and How Much?”