If you’re interested in gaining insights into the future performance of Tesla and Tesla stock price prediction, you’ve come to the right place.

In this article, we will provide a comprehensive analysis of Tesla’s stock price prediction for the years 2023, 2025, 2030, and beyond. Our predictions are based on extensive research encompassing financials, historical data, recent quarter performance, and technical indicators related to Tesla.

Tesla ( Ticker: TSLA) Overview

Tesla, a trailblazer in the EV industry, requires no introduction. However, its journey wasn’t without obstacles. Initially, the company faced significant challenges and even came to the brink of bankruptcy, struggling to turn a profit for several years.

It wasn’t until 2020, after nearly 18 years, that Tesla achieved its first profitable year. Despite being a pioneer in the EV industry, recent years have witnessed a surge in competition. Traditional car manufacturers and emerging EV companies like Lucid and Rivian have emerged, posing formidable challenges for Tesla.

The intensifying competition in the EV space raises intriguing questions about Tesla’s ability to navigate these obstacles and continue to excel in the future. Moreover, the impact of this competition on Tesla’s stock price in the coming years and decades holds considerable significance. It will be captivating to observe how Tesla rises above these challenges and maintains its position as an industry leader.

Tesla Growth and Competitive Landscape

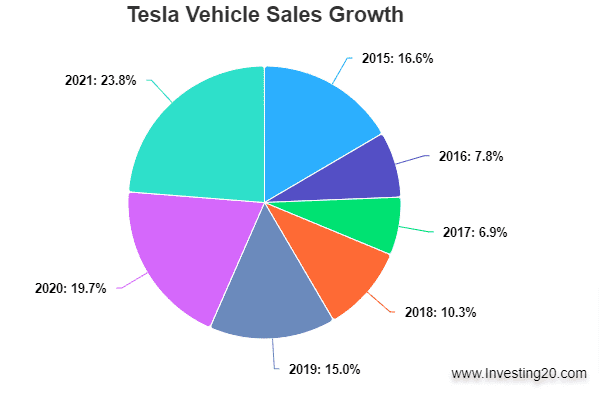

Tesla has been consistent in growing their sales year over year since their inception. And throughout these years they have also been investing heavily in the Research and development side as well which has helped accelerate the growth further.

By prioritizing innovation and technological advancements, Tesla has successfully propelled its expansion in the market. The combination of robust sales performance and strategic investments in R&D has proven instrumental in driving Tesla’s continued success.

On the other end, the competition within the EV market has intensified significantly in recent years, largely due to various catalysts. One such catalyst is the Ukrainian war, which has caused a substantial shift in fossil fuel prices within the US market.

As a result, many traditional car manufacturers have swiftly adapted to this changing landscape. Some have established their own dedicated production lines specifically for EV manufacturing, while others have modified their existing lines to increase the pace of EV production.

Check Out: Palantir Price Prediction

Amidst this evolving market, notable newcomers such as Rivian and Lucid Motors have emerged alongside established players. These fresh entrants have garnered positive reviews, particularly within their respective niche vehicle segments.

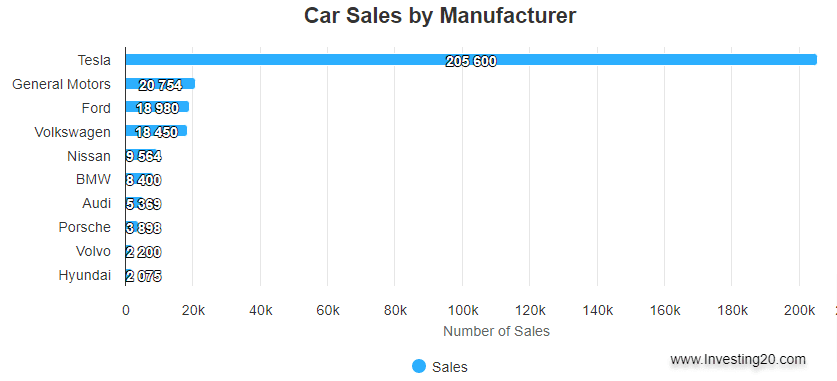

General Motors and Ford, on the other hand, stand out as an exception among the traditional players which is catching up fast on the overall delivery numbers. The presence of these new contenders adds an additional layer of competition and diversity to the dynamic EV market.

Tesla (TSLA) Stock And Financial Overview

| Stock Name | Tesla |

| Ticker | TSLA |

| Website | www.tesla.com |

| Sector | Consumer |

| Market Cap | $580B |

| Employees | 100K+ |

| CEO | Elon Musk |

Let’s take a look at the company’s finances. The data is sourced in real time from TradingView.

Latest Developments That May Impact Stock

Linda Yaccarino's appointment as the new CEO of Twitter has generated a positive response among investors. This development comes as a relief, considering the concerns that arose when Elon Musk took over Twitter, casting a shadow of uncertainty over Tesla.

Market participants were apprehensive about how he would juggle responsibilities between both companies and whether it would divert his focus away from Tesla. With the clarity provided by Linda Yaccarino’s leadership at Twitter, we can anticipate a much-needed boost in Tesla’s stock prices. This positive sentiment is already evident, as the stock prices have witnessed a notable 7% increase in just the past week.

This week, Tesla engaged in discussions with Indian officials, covering a range of subjects, including incentives related to car and battery manufacturing. The outcome of these deliberations holds great interest, as it will shape the future trajectory of Tesla's operations in India.

Moreover, we can anticipate that any significant developments resulting from these talks will likely have an impact on Tesla’s stock prices. It is an exciting period to monitor as Tesla navigates its entry into the Indian market and assesses the potential for growth and expansion in this dynamic region.

Tesla Stock Price Prediction and Forecast

Based on all the factors and challenges that we have outlined so far in this article we have established some predictions for the Tesla stock for the next few years and decades.

While these predictions can provide valuable insights, it’s important to approach them with caution, as they may change if there are significant changes in macroeconomic situations.

As with any investment decision, conducting thorough research, consulting with financial experts, and monitoring relevant market developments are essential for making informed decisions regarding any stock.

Here is a snapshot of the long-term forecast for Tesla stock.

| Year | Minimum Price | Maximum Price |

|---|---|---|

| 2023 | $185 | $220 |

| 2024 | $200 | $304 |

| 2025 | $298 | $390 |

| 2030 | $652 | $770 |

| 2040 | $1200 | $1520 |

| 2050 | $2800 | $3000+ |

Tesla Stock Price Prediction 2023 | Tesla (TSLA) Stock Forecast 2023

According to industry experts and Tesla’s Financial and Technical analysis, the prediction for 2023 is between $185 and $220. In a bull case scenario, the price is expected to be $220 on the higher side, and in a bearish scenario, it is expected to be $190.

| Year | Tesla Stock ( TSLA) Price Prediction |

|---|---|

| 2023 | $185 – $220 |

Tesla Stock Price Prediction 2024 | Tesla (TSLA) Stock Forecast 2024

In the year 2024, Tesla stock is expected to hit a high of $304 and on the low side, it could go up to $200. Based on the recent trends it is expected that Tesla cyber truck deliveries will be in full swing this year and a lot of revenue and price action could depend on how well the cyber truck does in the market.

| Year | Tesla Stock ( TSLA) Price Prediction |

|---|---|

| 2024 | $200 – $304 |

Tesla Stock Price Prediction 2025 | Tesla (TSLA) Stock Forecast 2025

This year, the electric vehicle (EV) market is set to witness the launch of numerous new EV models, intensifying the competition that Tesla will face from its rivals. The impact of this heightened competition is anticipated to manifest in Tesla’s stock prices as well, reflecting the market’s response to the evolving competitive landscape.

In response, Tesla is strategically planning to expand its presence in emerging markets. The company aims to establish successful production plants in these regions, which could contribute significantly to bolstering its overall revenue figures. This expansion into new markets presents an opportunity for Tesla to tap into untapped potential and diversify its global footprint.

Based on our comprehensive research and informed predictions, we anticipate Tesla’s stock prices to exhibit a range-bound movement between $298 and $390 by the year 2025.

| Year | Tesla Stock ( TSLA) Price Prediction |

|---|---|

| 2025 | $298 – $390 |

Tesla Stock Price Prediction 2030 | Tesla (TSLA) Stock Forecast 2030

AI would be a big player a decade from now and if Tesla can enhance and fine-tune its self-driving capabilities successfully then that will give Tesla a big edge over its competitors.

On the flip side if it fails to materialize on the self-driving capabilities then it may face challenges in terms of scalability and maintaining the operating profit margins.

Based on the current indicators we can expect Tesla Stock to be in the mid to high $650 range for the year 2030.

| Year | Tesla Stock ( TSLA) Price Prediction |

|---|---|

| 2030 | $652 – $770 |

Tesla Stock Price Prediction 2040 | Tesla (TSLA) Stock Forecast 2040

While this scenario is still a long way off, envisioning a future where Tesla successfully expands its production hubs beyond China and manages to significantly lower the cost of producing an electric vehicle (EV) priced below $25,000, reveals immense potential for the company to maintain its position as a market leader in the EV space.

Of course, a lot of variable factors are in play here but if all goes as expected then we are predicting Tesla’s stock price in 2040 in between $1200 to $1520.

Overall the bull case is still in favor of Tesla and it should definitely hit the $1200 mark by 2040.

| Year | Tesla Stock ( TSLA) Price Prediction |

|---|---|

| 2040 | $1200- $1520 |

Tesla Stock Price Prediction 2050 | Tesla (TSLA) Stock Forecast 2050

Taking into account the bullish outlook, it is expected that Tesla’s stock could surpass $2,800 by the year 2050. Additionally, it is possible that there may be a few stock splits during this period, resulting in the stock prices no longer being reflected in dollar value.

However, based on our projections, we anticipate that the equivalent value of these split-adjusted shares could reach $3,000 or more. These estimations reflect an optimistic perspective on Tesla’s potential for long-term growth and continued market success.

| Year | Tesla Stock ( TSLA) Price Prediction |

|---|---|

| 2050 | $2800 – $3000+ |

FAQ

Is Tesla good long-term stock?

Yes, Tesla has experienced both success and challenges but looking at the untapped market share in the EV industry as a whole Tesla will be playing a major role in that and Tesla stock is expected to be multifold in coming years and decades.

How did the company get its name, Tesla?

The company Tesla derived its name from the renowned Serbian-American inventor and engineer, Nikola Tesla.

What will Tesla stock be worth in 2040?

The Tesla stock is expected to cross the $1500 mark by the year 2040. Of course, there are various factors in play between now and then but with an optimistic outlook it is fair to say that Tesla will easily cross $1500 by 2040.

How much will Tesla stock be worth in 5 years?

Based on our long-term forecast, Tesla is expected to be around $650 in the next 5 years. On the more optimistic view, it may go up to $800.

How much will Tesla stock be worth in 10 years?

In the next 10 years, Tesla is expected to cross $1000 provided it maintains a steady pace of both revenue and profit margin growth year over year.

Is Tesla good stock to buy?

If you are seeking to allocate a portion of your portfolio to the growth market, Tesla is widely regarded as a favorable investment option. While it is important to acknowledge that investments of this nature often come with inherent volatility, Tesla has demonstrated a noteworthy achievement by becoming the first electric vehicle (EV) company to achieve profitability.

This track record of success solidifies Tesla’s position as a reliable and pioneering player within the EV industry. Considering these factors, investing in Tesla offers the potential for both growth and stability, making it an attractive choice for investors looking to capitalize on the evolving market trends.

Is Tesla a good investment in 2023?

Tesla is down almost 40% from its recent high and as of now, the stock is positioned at a favorable price level, making it an attractive investment opportunity for the year 2023.

Is Tesla a profitable investment?

Tesla has demonstrated a noteworthy achievement by becoming the first electric vehicle (EV) company to achieve profitability.

And this track record of success solidifies Tesla’s position as a reliable and pioneering player within the EV industry. Considering these factors, investing in Tesla offers the potential for both growth and stability, making it an attractive choice for investors looking to capitalize on the evolving market trends.

Is Tesla (TSLA) the right stock for the future?

EV has a lot of market share that is still untapped and Tesla is expected to take the majority of that market share and in that regard, Tesla is the right stock if you are interested to set aside a portion of your portfolio into the growth sector.

Is Tesla a Buy, Sell, or Hold?

Tesla has been down quite a bit from its recent highs and based on current stock price and according to several market analysts Tesla maintains a buy rating.