In this article, we will be going over the PLTR Stock Forecast (Palantir Technologies) for years spanning from 2023 to 2030. This was a name that likely caught your attention during the pandemic when it made its debut in the investment world. Join us as we explore the fundamental aspects of Palantir stock and provide insightful predictions for the years ahead, spanning from 2023 to 2030.

The predictions are solely based on personal analysis of the market and stock. You should always do your own research before investing however the aim of this article is to give you all the correct information so you can make an informed decision. So without further ado, let’s start with the analysis and PLTR stock forecast.

What is Palantir Technologies?

Palantir Technologies is a software and data analytics company founded in 2003 by Peter Thiel, Nathan Gettings, Joe Lonsdale, Alex Karp, and Stephen Cohen. The company provides software solutions for data integration, management, and analysis for a wide range of clients, including government agencies, financial institutions, and healthcare companies.

In 2020, the company went public through a direct listing on the New York Stock Exchange, with a valuation of over $22 billion. The company has continued to grow since then, with its share price increasing by over 100% in the first year of trading.

Palantir stands out from other software companies due to its remarkable proficiency in securing and maintaining significant government contracts. The driving force behind this success lies in its flagship data analytics software, which heavily incorporates artificial intelligence (AI) capabilities. By adopting a Software as a Service (SaaS) model, Palantir ensures a consistent stream of revenue generation, bolstering its financial stability. This strategic approach has proven to be highly effective for the company.

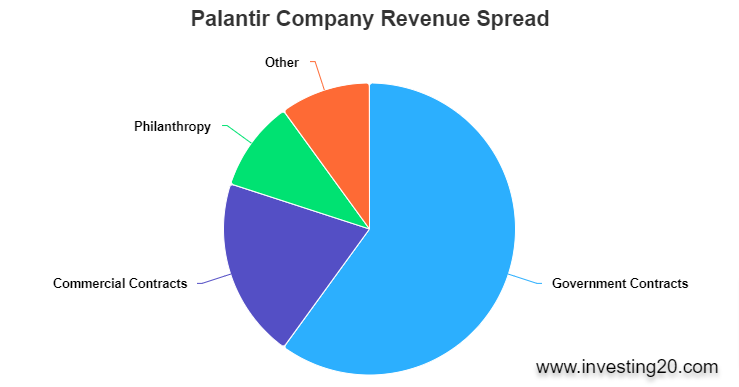

Palantir Revenue Landscape

Government contracts serve as the primary revenue source for Palantir Technologies, aligning with their core expertise. These long-term contracts contribute to approximately 60% of their overall revenue. While Palantir also earns revenue from commercial contracts, philanthropic endeavors, and other sources, the majority of its income stems from government contracts.

Palantir Platforms

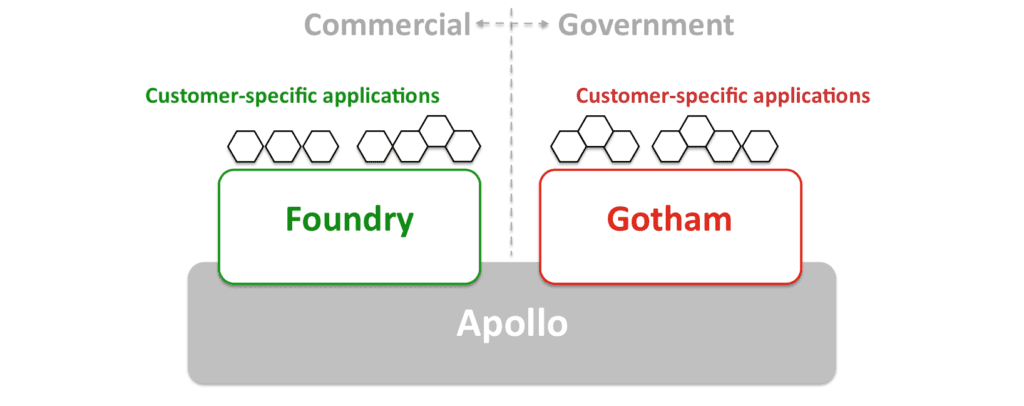

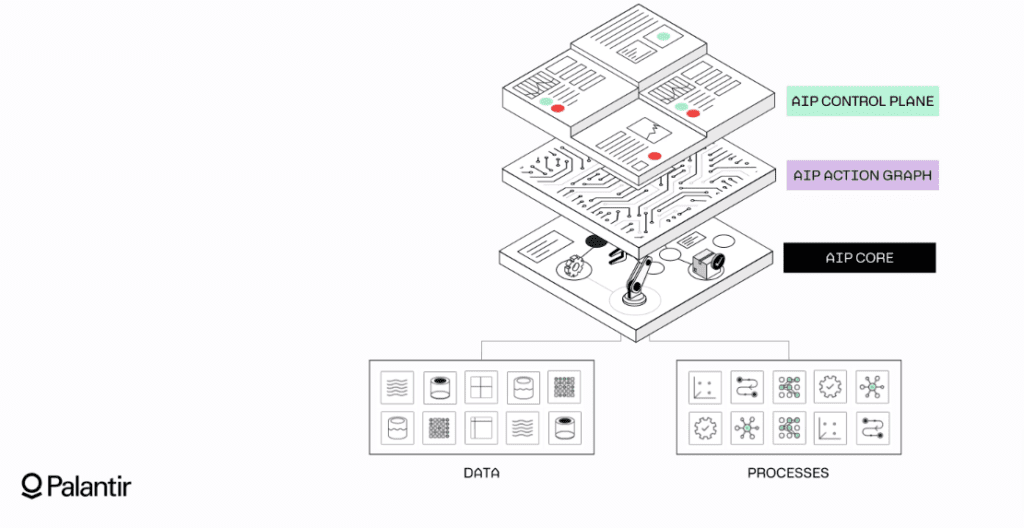

Palantir offers a range of software solutions through its four primary platforms: Foundry, Gotham, Apollo, and the recently introduced Artificial Intelligence Platform (AIP). The company follows a Software as a Service (SaaS) model for these platforms.

With Foundry, Gotham, and Apollo already established, Palantir aims to target the defense systems sector with its latest addition, AIP. In a recent interview, CEO Alex Karp highlighted the capabilities of AIP, emphasizing its potential to empower customers by harnessing the power of Palantir’s existing machine-learning technologies and integrating them seamlessly with large language models.

By leveraging AIP, customers can directly access and benefit from these advanced technologies within Palantir's established platforms, creating new opportunities for enhanced data analysis and decision-making capabilities.

Palantir ( Ticker: PLTR) Fundamentals

Before diving deep into the future prediction it’s worth looking at the company’s fundamentals. Palantir’s growth prospects look strong, with the company continuing to win major contracts and expand into new markets.

However, recent economic downturns and competition from other major players in the data analytics area are some of the challenges that Palatir will have to closely monitor. PLTR stock is down almost 30% last year which has put it in a nice valuation area and this should be the right time to get into this stock.

Latest Trends That May Impact Palantir Stock

Palantir achieved quarterly GAAP profitability for the first time, showing that the company surely has enough potential to become increasingly profitable as it advances. It has also provided a solid future outlook in the recent quarterly results.

In a recent interview with Palantir CEO Alex Karp said that Ukraine has been using its software for its war against Russia. He said that its software helps Ukraine target, for instance, tanks and artillery.

The current momentum behind the artificial intelligence trend is expected to significantly benefit Palantir stock. With their dedicated efforts in developing the AI-based AIP platform, Palantir is poised to experience a positive impact on its stock performance. The increasing focus on artificial intelligence technology presents a promising opportunity for Palantir and reinforces the potential for growth in its stock value.

Additionally, the recent announcement of Nvidia’s earnings surpassing market expectations by a significant margin, driven in large part by the success of AI, particularly generative AI, has further positive implications for Palantir.

As a major player in the AI industry, Palantir's stock price is expected to receive a substantial boost as a result of this news. The remarkable performance of Nvidia in the AI sector reinforces the growing demand and potential profitability of AI-related technologies, which bodes well for Palantir's future prospects and stock value.

Also, Check Out: NVIDIA Price Forecast

PLTR Stock Forecast 2023 | PLTR Stock Prediction 2023

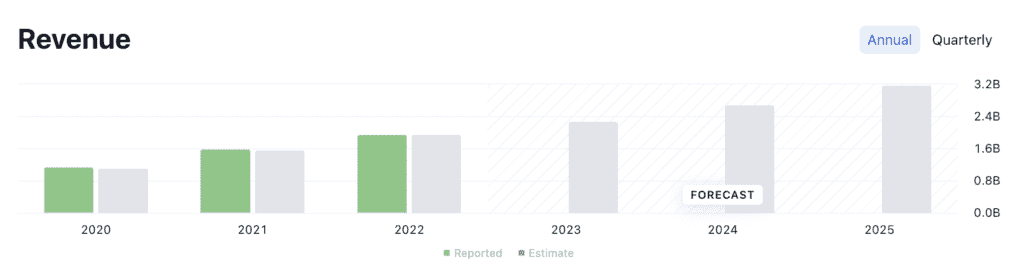

PLTR’s revenue is forecasted to be around 2.21B for the year 2023 and if we take a moderate P/S ( Price to Sales) ratio of about 8 which is moderate based on their current price to sales of around 13 we are expecting PLTR to reach a high of $14 by the year 2023.

| Year | Price Range |

| 2023 | $8.7 – $15 |

PLTR is expected to fluctuate between $8.7 to $15 for 2023. The bull case prediction is about $14 and the bear case prediction is about $8.

Check out: Price Prediction for Lucid Motors

PLTR Stock Price Prediction 2025 | PLTR Stock Forecast 2025

PLTR has reported much better results in its recently released quarterly result and it has started the year 2023 on a very positive note. They have also given good guidance on their future prospects.

If they can successfully mitigate some of the challenges it has been facing in terms of diversification into other sectors PLTR has a huge potential couple of years down the line.

Based on the forecasted revenue of about 3.2B by the year 2025, they have a chance to gap up to $20 by the 2025 year-end. Below is the range based on our analysis that PLTR is expected to be in the year 2025.

| Year | Price Range |

| 2025 | $16.93 – $25.67 |

PLTR Stock Forecast 2030 | PLTR Stock Prediction 2030

Although it is very early to forecast how PLTR will do in the next 8 to 10 years as the company is still not in the profitability numbers so we don’t have many fundamentals to gauge the future performance.

Having said that, Palantir’s growth prospects look very strong, with the company continuing to win major contracts and expand into new markets.

In particular, the company is well-positioned to benefit from the increasing demand for data analytics solutions in a wide range of industries. As more and more organizations seek to make data-driven decisions, the demand for software and services like those offered by Palantir is likely to continue to grow.

Check Out: Price Prediction for NIO

They have some unique in-class data analytics software particularly built bottoms up for the defense sector. If they can successfully diversify their clientele beyond the US market it has a huge potential to capture a significant portion of market share in this space.

| Year | Price Range |

| 2030 | 80+ |

According to various analysts’ ratings on PLTR and our analysis of the stock we expect a CAGR growth of about 25-30% and the stock price to easily cross $80 by the year 2030.

FAQ

This is a list of frequently asked questions that people have asked about NIO Stock.

What will the PLTR price be in 2023?

Based on their current and forecasted revenue and other factors, PLTR stock can go as high as $15 by the end of 2023.

What will PLTR be worth in 2025?

According to several analysts, PLTR stock has an overall buy rating. It is expected to cross $25 by the year 2025.

Is PLTR undervalued?

We think PLTR is slightly undervalued currently. PLTR stock has dropped almost 70-80% from its all-time highs and it is sitting comfortably in the buy zone now based on all the available data.

What is PLTR 3 year forecast?

Palantir has posted better than expected last quarter results and in the next three years, Palantir is expected to easily cross $25. You may get a more in-depth analysis of this inside the article.

Will PLTR hit $100?

Yes, Palantir has a very good chance of hitting $100. Although it may not happen in the very near term. However, as per our analysis, the PLTR stock is expected to go as high as $80 by the year 2030 and $100+ somewhere around 2035. With recent developments of AI Palatir has a good chance to hit these benchmarks even sooner than that.

What is the target price for PLTR 2023?

With a recent trend of AI and considering the future scope of generative AI in the tech industry. Palantir is one of the best stocks to get into 2023. The recent quarterly result of Palatir just demonstrates a strong recovery and a clear path to reach an all-time high by year-end. It should reach a high of $15 by 2023.

What is the target price for PLTR 2024?

2024 is expected to be better in general for the market due to expected easing of the interest rates and overall economy. The AI market specifically has shown tremendous promise in the second of of the 2023 and the trend is expected to continue. Considering all these factors Palantir is best positioned in 2023 to take advantage of the AI boom. The expected price range for Palantir in 2024 is between $16 – $28.

Final Thoughts

Overall Palatir is one of its kind in the software and data analytics space. They have built a good repo among major government and defense agencies. Their propriety products like GOTHAM are already integrated and being used on major US defense projects.

As they continue to penetrate more into the defense space they will have a tremendous amount of data to further enhance and optimize their current products. It would be very hard and close to impossible to remove PLTR from their existing SAAS contracts.

As far as PLTR stock price goes it is sitting at a very attractive valuation at the current price point. And considering the recent trend and future scope of AI, Palantir is one of the best growth stocks to buy in 2023. It has great potential to be multifold in the next couple of years.

Disclaimer: This is a prediction based on a consolidated analysis of different experts however it accounts for many factors that depend on future microeconomic environments and that could change over the next few years. Always do your own research before buying into any investments.

2 thoughts on “PLTR Stock Forecast For 2023, 2025 and 2030: Will PLTR hit $100?”