Warren Buffett widely regarded as one of the most successful investors of our time, has recently revealed his favorite stock: Apple Inc. As the chairman and CEO of Berkshire Hathaway, Buffet’s investment decisions influence a lot in the world of finance.

In this article, we will delve into the reasons behind Buffet’s preference for Apple and explore the key factors that make it his favorite stock.

Favorite Stock of Warren Buffett: Apple Inc.

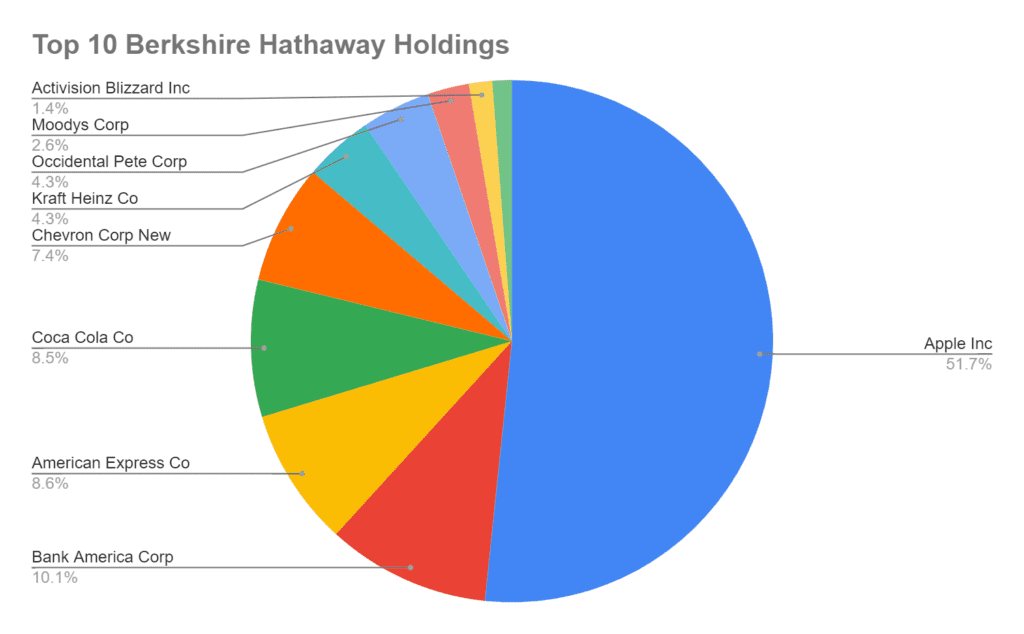

These are the top 10 holdings of Berkshire Hathaway based on recent data. As you can clearly see Apple makes more than half of this portfolio.

In a recent interview Buffet stated, “Our Criteria for Apple was different than the other business we own – It just happens to be better business than any we own.” This quote highlights Buffet’s unique perspective on Apple and sheds light on the exceptional qualities that set it apart from other businesses in Berkshire Hathaway’s portfolio.

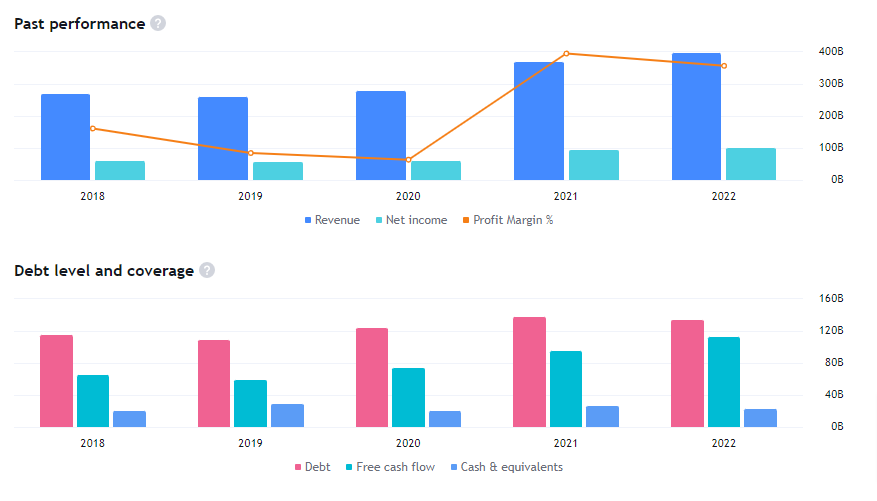

And there are very logical and valid reasons behind his decision. Firstly, Apple’s financial strength is unparalleled. The company boasts a staggering free cash flow of 98 billion dollars, a testament to its ability to generate substantial profits.

To add to that, Apple has consistently grown its cash flow by an impressive 85% over the last five years. This growth far surpasses that of other tech giants, such as Tesla, which has a mere 5 billion dollars in free cash flow—20 times less than Apple.

More Business News

The success of Apple can be attributed to its consistent innovation and product diversification. The company has a track record of introducing groundbreaking technologies and captivating consumers with its sleek and user-friendly devices. Warren himself quoted in interviews that “iPhone is an extraordinary device”

Now, let’s address Warren Buffet’s emphasis on liquidity. Buffet has famously stated, “We want to own good business and we also want to have plenty of liquidity and beyond that, the sky is the limit.”

This quote underscores the importance of liquidity in Buffet’s investment strategy. Maintaining ample liquidity allows Berkshire Hathaway to seize investment opportunities swiftly and capitalize on market fluctuations.

You may be eligible for a portion of a $750 Million Facebook privacy Settlement. Check Now.

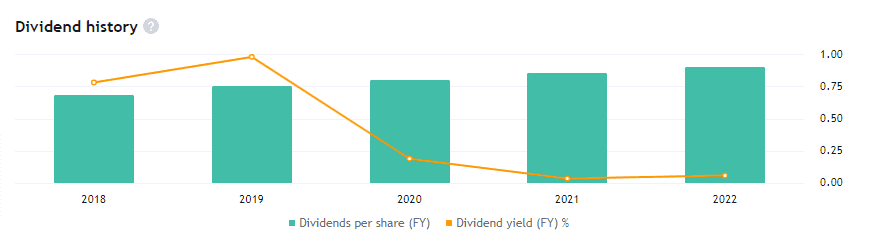

Apart from all these Apple is one of the very view tech companies that has been paying dividends consistently.

In my personal view, everyone who is remotely into investing should have Apple in some portion of their portfolio. It is one of the most stable companies in the world and the financial numbers speak for itself.