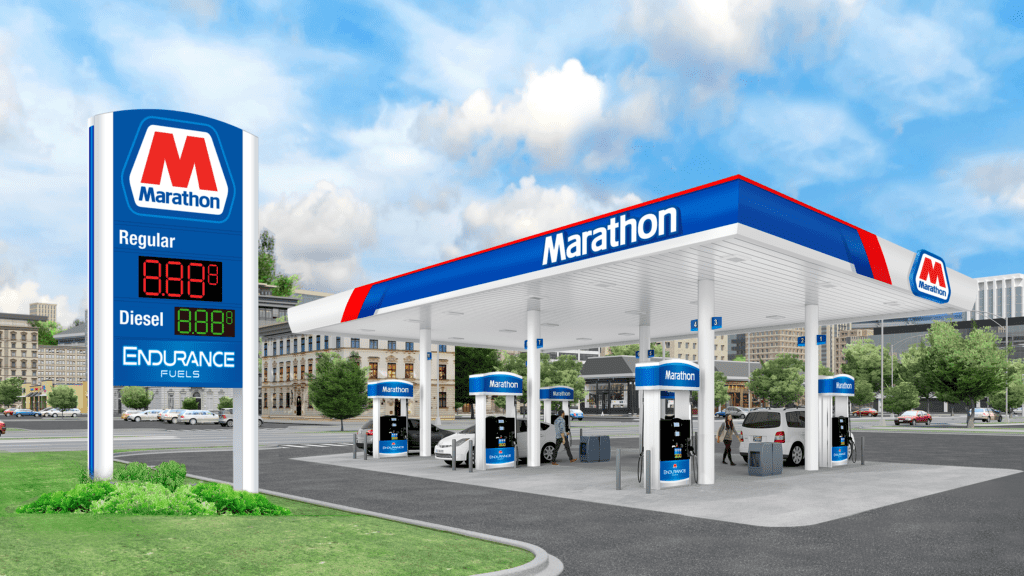

In this article, we will discuss the MPLX stock forecast ( Marathon Petroleum Corporation ), considered one of the good dividend stocks in the market. We will first look at the MPLX stock fundamentals and then follow with the MPLX forecast for years between 2022 till 2050.

The predictions are solely based on personal analysis of the market and stock. You should always do your own research before investing however the aim of this article is to give you all the right information so you can make an informed decision. So without further ado, let’s start with the analysis and prediction of MPLX stock.

What is MPLX?

MPLX is a publicly traded master limited partnership (MLP) headquartered in Findlay, Ohio that operates a diversified portfolio of midstream energy infrastructure assets. These assets include pipelines, storage tanks, and terminal facilities that are used to transport store and distribute crude oil, refined products, and natural gas.

MPLX was formed in 2012 as a spin-off of Marathon Petroleum Corporation, one of the largest refining and marketing companies in the United States. Since its inception, MPLX has grown rapidly through a combination of organic growth and strategic acquisitions. As of 2021, the company’s assets include more than 9,500 miles of pipelines, 50 million barrels of storage capacity, and 25 terminal facilities located in the Midwest, Gulf Coast, and Western Canada.

Company Fundamentals

Before diving deep into the future prediction it’s worth looking at the company’s fundamentals. MPLX has a strong financial position, with a credit rating of BBB+ from S&P Global Ratings and a history of steady distribution growth.

Market Cap

$32.45B

Income

$3.83B

Sales

$11.18B

EPS Q/Q

87.60%

Sales Q/Q

13%

52 Week Range

$27.47 – $35.49

Dividend %

9.4%

Data for company fundamentals in the above table is referenced from FinViz as of 01/01/2023. For the latest and up-to-date data please refer here.

MPLX Stock Price Analysis In 2022 | MPLX Stock Dividend 2022

One key factor that has contributed to MPLX’s growth is its focus on diversification. The company’s assets are spread across a wide range of regions and energy products, which helps to reduce its exposure to any single market or commodity price. In addition, MPLX has a strong financial position, with a credit rating of BBB+ from S&P Global Ratings and a history of steady distribution growth. The dividend payout from MPLX has been consistent throughout 2022 and expects to be the same in the coming years.

Also Read: Rivian Price Prediction for coming years

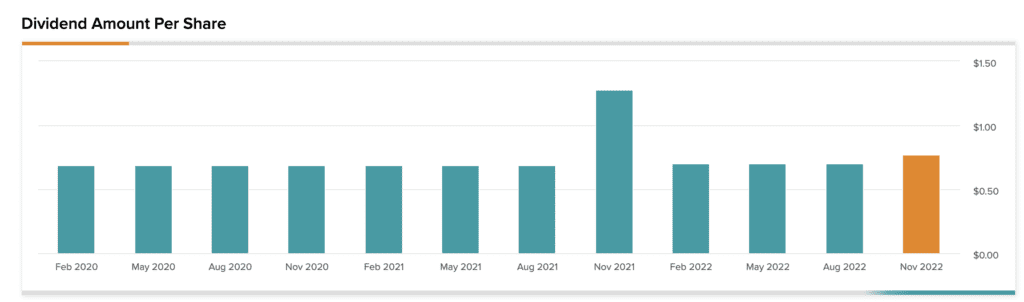

MPLX Stock Dividend | MPLX Stock Dividend History

MPLX pays its dividend on a quarterly basis and it has been very consistent in its dividend payout. The dividend payout range is $0.69 – $0.77.

MPLX stock forecast 2023 | MPLX stock price forecast

Year

Price Range

2023

$33.50 – $44

According to various analysts and our research team’s analysis, the price of MPLX will be between $33.50 to $44 for 2023. The bull case prediction is about $44 and the bear case prediction is approximately $33.50.

One key factor that could drive growth for MPLX is the increasing demand for energy infrastructure assets. As the world population continues to grow and economies expand, the need for reliable and efficient energy transportation will also increase. MPLX is well-positioned to meet this demand, with a diverse portfolio of assets strategically located to serve key markets.

MPLX stock forecast 2025 | MPLX stock price forecast 2025

Year

Price Range

2025

$54.50 – $71.58

According to several analysts, the prediction for 2025 is between $54.50 and $71.58. In a bull case scenario, the price is expected to be $71 on the higher side and in a bearish scenario, it is expected to be $54.

Also Read: Lucid Price Prediction from 2022 to 2050

MPLX stock forecast 2030 | MPLX stock price forecast 2030

Year

Price Range

2030

$86 – $112.96

According to industry experts and Lucid financial reports, the prediction for 2025 is between $86 and $112.96. In a bull case scenario, the price is expected to be $112 on the higher side and in a bearish scenario, it is expected to be $86.

MPLX stock forecast 2040 | MPLX stock price forecast 2040

Year

Price Range

2040

$128 – $168.12

According to several analysts, the prediction for 2040 is between $128 and $168.12. In a bull case scenario, the price is expected to be $168 on the higher side; in a bearish scenario, it is expected to be $128.

MPLX is probably one of the safest stocks that pay a 9% dividend yield and managed to grow the dividend payment. The company has been generating consistent cash flows and efficiently managing capital. Considering the growing energy demand and 10% dividend payout which would increase with time there is strong investor interest in MPLX stock.

MPLX stock forecast 2050 | MPLX stock price forecast 2050

Year

Price Range

2050

$250+

MPLX is a strong and well-positioned company that is well-suited to capitalize on growth opportunities in the midstream energy sector. With its diversified portfolio of assets, strong financial position, and track record of executing its growth strategy, the company is well-positioned to continue expanding in the years ahead. Keeping all these factors in view, it can very well touch $250+ in stock price by 2050.

Forecasts for MPLX stock prices in 2023, 2025, 2030, 2040, and 2050 | MPLX Stock Forecast From 2023 To 2050

Year

Price Range

2023

$5.72-$11.60

2025

$54.50-$71.58

2030

$86-$112

2040

$128-$168

2050

$250+

Based on various industry experts and our own research on the stock above is a summary of MPLX stock forecasts in 2023, 2025, 2030,2040, and 2050.

Frequently Asked Questions | MPLX Stock forecast FAQ

This is a list of frequently asked questions that people have asked about MPLX Stock.

What will MPLX stock be worth in 2025?

Based on several industry experts, MPLX is expected to touch $71 by end of 2025.

MPLX stock buy or sell?

Based on analysts’ reports and consensus MPLX is a moderate buy. It has about $18% upside potential in the coming years.

Is MPLX stock a good buy?

Yes, based on several industry analysts’ reports it has a moderate buy rating and has good upside potential. Apart from that, it is a good dividend paying stock which makes it more attractive.

Is MPLX a good company?

MPLX is a strong and well-positioned company that is well-suited to capitalize on growth opportunities in the midstream energy sector. With its diversified portfolio of assets, strong financial position, and track record of executing its growth strategy, the company is well-positioned to continue expanding in the years ahead.

Where can I buy MPLX stock?

MPLX is a publicly traded company and you can buy this from any broker’s platform. Some of the popular platforms include Robinhood, Webull, Vanguard, Fidelity, etc.

Will MPLX go up?

Based on industry experts’ analysis MPLX has a moderate buy rating and has an upside potential of about 17-18% in coming years.

How often does MPLX pay a dividend?

MPLX pays a quarterly dividend payout. The dividend is paid usually in February, May, August, and November.

Is MPLX a publicly traded company?

Yes, MPLX is a publicly traded company. It is a master limited partnership (MLP) that is listed on the New York Stock Exchange (NYSE).

Does MPLX pay monthly dividends?

No. MPLX pays quarterly dividend payments.

What months does MPLX pay dividends?

MPLX pays quarterly divided usually in the month of February, May, August, and November.

Is MPLX dividend sustainable?

Based on the previous dividend payment history and the growth in the energy section MPLX divided is very well sustainable.

Who owns MPLX stock?

MPLX is a large-cap master limited partnership formed by Marathon Petroleum Corporation that owns and operates midstream energy infrastructure and logistics assets and provides fuel distribution services.

How long has MPLX been in business?

MPLX was formed in 2012 as a spin-off of Marathon Petroleum Corporation, one of the largest refining and marketing companies in the United States. So, MPLX has been in business for about 11 years.

Final Thoughts

To conclude this article about the MPLX stock forecast, it has a good potential to have sustained growth in both stock price and dividend payout in the coming future in 2025, 2030, 2050, and beyond.

Disclaimer: This is a prediction based on a consolidated analysis of different experts however it accounts for many factors that depend on future microeconomic environments and that could change over the next few years. Always do your own research before buying into any investments.